Many entrepreneurs start their business with little more than a dream and a shoestring budget. In fact, some business models require very little up-front costs, and at Shopify, we’ve personally witnessed the success of countless entrepreneurs with humble beginnings. But among the small businesses that get their business off the ground and don't last, more than a third cite a shortage of cash as the reason.

We wanted to understand: how much does it cost to run a business—really? And do aspirational entrepreneurs have any misconceptions about what those costs will look like in their first year of business? In October, we surveyed 150 aspirational entrepreneurs and 300 small business owners in the US to find out exactly that.

How much does it cost to run a business?

According to our research, small business owners spend an average of $40,000 in their first full year of business.

This doesn't mean you need $40,000 in cash lying around to start a small business. In fact, for many founders, first-year costs are incurred in the process of earning business—and revenue is reinvested from the business to cover expenses. Not to mention, businesses with employees spend a lot more than solopreneurs, which skews this number higher. But more on all that later.

- Product: raw materials, inventory, supplier, manufacturing, patents, etc.

- Operating: incorporation/legal fees, additional software, accounting, etc.

- Online store: website/platform subscription, hosting/domain, contract developer/designer, etc.

- Shipping: packaging, labels, etc.

- Offline: stall/table fees, rent, gas, etc.

- Team/Staff: salaries, benefits, perks, etc.

- Marketing: logo, branding, ads, printed materials, etc.

📊 What our research shows

In their first year, small businesses spent:

- 11% on operating costs

- 10.3% on marketing costs

- 9% on online costs

- 31.6% on product costs

- 8.7% on shipping costs

- 18.8% on team costs

- 10.5% on offline costs

It's important to note that the amount businesses spent in their first year varied significantly, depending on factors like industry and business model; whether the business was a full-time, part-time, or hobby venture; and whether the business had any employees. But more on that later.

Sources of financing for early-stage founders

While new entrepreneurs often rely on their personal savings to keep their business afloat in the early days, one third of respondents reported reinvesting revenue from their business sales to cover their business costs in the first year.

📊 What our research shows

Top funding sources for business owners:*

- Personal Savings (66%)

- Reinvesting revenue from sales (30%)

- Financial support from friends and family (23%)

- Personal Loan (21%)

* Respondents could select more than one funding source

👀 Why it matters

Accepting that your first year of business may not be hugely profitable is important for financial planning—and mental preparation. In many cases, founders are the last to be paid in their first year as all of the company’s revenue goes back into the business. And that’s perfectly normal.

For the companies that are struggling to make any sales in their first year, creating a comprehensive financial plan outlining how much you’re going to need and what you’re going to use it for will make it easier when you’re applying for a bank loan or raising money. Don’t think of this as taking on debt—expenses are incurred in order to generate revenue, so the return on your investment will likely be greater than the upfront costs.

How much businesses spend in their first year depends on the size of their team

Perhaps unsurprisingly, having employees dramatically increases overall spend. If you choose to go the solopreneur route, you can spend less than one-third what businesses with employees spend.

📊 What our research shows

- Business owners with zero employees spent $18,000 in their first year.

- Business owners with one to four employees spent $60,000 in their first year.

Unexpected costs in the first year

Beyond fixed costs, business owners also noted common one-time costs that sprung up in their first year and warned of hidden expenses to look out for.

📊 What our research shows

The most-cited unexpected costs of running a business were:

- Shipping. 34% of businesses cited packaging costs, damaged or returned items, and general shipping fees. This was particularly painful for businesses with low shipping volumes in the early stages.

- Legal. 23% of businesses cited one-time startup costs like insurance, licenses, and permits as unexpectedly costly. They were also surprised that they were charged to incorporate both state-wide and federally in the US.

- Inventory and product. 21% of businesses said that costs associated with their inventory, such as product testing and receiving and returning defective products, as well as surplus inventory, could quickly rack up bills.

- Taxes and accounting. In the qualitative component of our study, business owners repeatedly mentioned taxes and accounting as painfully cumbersome—and worth hiring professional help for.

👀 Why it matters

The more you know! Recurring expenses and fixed costs are only part of your financial plan—hidden costs, one-time costs, and variable costs also need to be planned for in advance. What happens if an unexpected event, like COVID-19, throws off your projections? It’s always a good idea to do some contingency planning and set aside a cash reserve, just in case.

Aspirational entrepreneurs overestimated online costs

When we asked our aspirational entrepreneurs how much they thought their first year of business would cost them, they wholly overestimated in one area: they expected online costs to be more expensive than established business owners reported.

📊 What our research shows

- Aspirational entrepreneurs expected to spend 12% of their budget on online costs in their first year.

- Business owners reported spending only 9% of their budget on online costs in their first year.

👀 Why it matters

Beyond ineffective budgeting, entrepreneurs who expect to spend more may end up paying more than they have to. The rationale is simple: if entrepreneurs are going into business expecting to spend more on a service, what they’re willing to pay for said service goes up accordingly.

It’s important that entrepreneurs do their research when choosing to hire designers or developers to avoid being overcharged—or opt for an ecommerce provider that vets and curates experts for you.

The perceived cost and complexity of launching an online business continues to be a salient barrier to entry for many aspirational entrepreneurs. But it’s largely unfounded. For Shopify’s part, our core ethos—or raison d’être, if you will—is to enable precisely those entrepreneurs who don’t have coding or design skills to build an online store. And to do so affordably.

Spending patterns among high-earning businesses

Just because business owners managed their budget a certain way in their first year doesn't mean it was the right way. Indeed, most of our respondents admitted that, in hindsight, they would have spent their money differently in their first year.

To provide better guidelines for aspirational entrepreneurs, we decided to look more closely at the data of businesses who reported higher revenue in their first year to see what—if any—budget decisions contributed to financial success. Here’s what we found.

High-earning businesses spend more on team costs

Businesses that reported higher revenue in their first year spent significantly more on team costs—almost one third of their total budget.

📊 What our research shows

- Businesses with a yearly revenue of less than $10,000 spent 8% of their budget on team costs.

- Businesses with a yearly revenue of $10,000–$100,000 spent 23% of their budget on team costs.

- Businesses with a yearly revenue of $100,000+ spent 32% of their budget on team costs.

👀 Why it matters

The relationship between revenue and team costs may seem like an obvious one—in other words, if you make more money you can afford to pay yourself and hire employees. But the relationship goes both ways: adding members to your team can drive revenue growth.

And while going at it alone is good business sense at the beginning, it’s worth noting that there’s a ceiling with this approach. When you’re a solopreneur, you have limited resources: they start and end with you. You’re limited to the skills you possess and the skills you’re willing to learn.

Many business owners reach a milestone in their career where they need to weigh the financial costs of hiring help with the time costs of doing everything by themselves.

It’s important that entrepreneurs know what red flags to look out for that indicate it’s time to hire help. Some red flags include turning down work because you can’t keep up, seeing the quality of your product or service suffering, or seeing the quality of your sleep or mental health suffering. Don’t put yourself in a position where you’re spread so thin that you can’t run your business in a sustainable way.

Businesses who made less in their first year spent more on marketing

When we asked business owners, “How much did marketing account for as a percentage of your overall budget?” we found a significant relationship between marketing spend and revenue.

The less money a business made overall, the more it spent on marketing. And the inverse was true too: the more money a business made overall, the less it spent on marketing.

📊 What our research shows

- Businesses with a yearly revenue of less than $10,000 spent 13% of their budget on marketing.

- Businesses with a yearly revenue between $10,000–$100,000 spent 7% of their budget on marketing.

- Businesses with a yearly revenue of $100,000+ spent 7% of their budget on marketing.

👀 Why it matters

If businesses are overspending on marketing without a clear return on investment, it could be an early sign of bigger problems, such as a website that doesn’t convert or worse yet, a weak product-market fit. It’s imperative then that business owners obsessively track, report, and revisit their marketing efforts on a regular basis.

Still, marketing is more of an art than a science, and getting the budget exactly right at the beginning is tough. Spend too little and you’re not getting your name out, spend too much and you’re not seeing a profitable return.

Our findings, as well as findings by experts from the US Small Business Administration, suggest that the sweet spot for a marketing budget for an early-stage B2C business is between 7% and 8% of revenue.

Our budget recommendations

We said it earlier but it’s important to reiterate: the costs of starting a business vary greatly and depend on many different factors, like the industry you’re operating in, your business model, the size of your team, your cost of goods, and so on. Ultimately, there is no right or wrong amount of money to spend in your first year, it’s about how you spend what you have.

Still, after analyzing trends among high-earning businesses and consulting startup advisers, there appears to be a general range that’s advisable to spend in each cost category in your first year:

- Operations: 10%–15%

- Product: 28%–36%

- Shipping: 8%–12%

- Online: 9%–10%

- Marketing: 7%–12%

- Team: 14%–30%

Remember: starting a successful business is a marathon, not a sprint. It’s critical then that you don’t measure the success of your business by your first year profitability. Give yourself a runway of 18-24 months for your business to get off the ground. Spend your first year testing, reiterating, and reinvesting your sales back into your business using the above budget guidelines.

Being an entrepreneur requires a certain appetite for risk. But with the right information and a clear sense of your financial goals, you can avoid many of the financial missteps common to new entrepreneurs. And with the right ecommerce platform, managing all the other moving parts is a whole lot easier, too.

*All of Shopify’s 2020 Cost of Starting a Business is based on survey data collected in October 2020 from 300 small business owners and 150 aspirational entrepreneurs in the US. All values are rounded averages. All data is unaudited and subject to adjustment. All financial figures are in USD unless otherwise indicated.

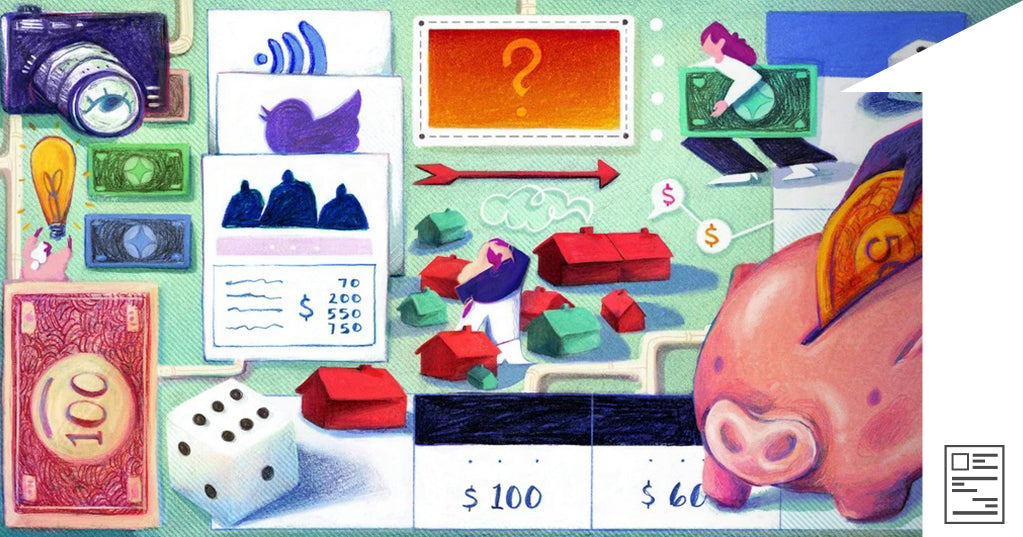

Illustration by Isabella Fassler

Data visualization by Datalands